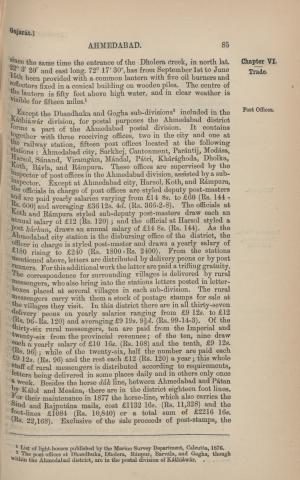

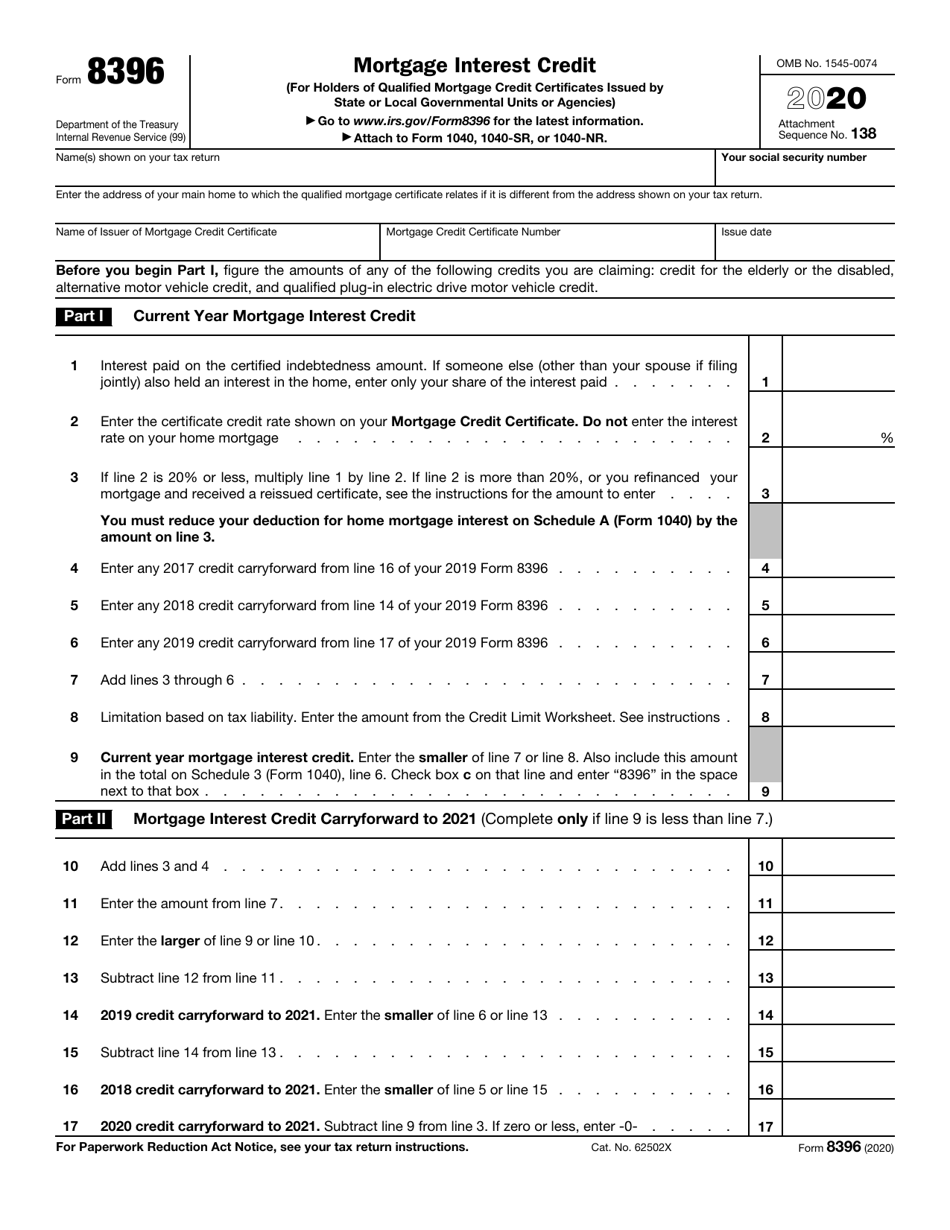

35+ form 8396 mortgage interest credit

Web Form 8396 Mortgage Interest Credit is separate from Form 1098 Mortgage Interest Statement you receive from your bank or financial institution for mortgage interest paid. Web The mortgage interest credit for a tax year is calculated on Form 8396 Mortgage Interest Credit by multiplying the mortgage interest the taxpayer paid or.

:max_bytes(150000):strip_icc()/mortgage-investment-credit-tax-form-8396-610648134-5dea203e3c5c4d81b66a8566d80fa18b.jpg)

What Is Form 8396 Mortgage Interest Credit How To Use

Web February 8 2022 533 AM.

. Get Your Taxes Done Right. Web Form 8396 is the form taxpayers can use to calculate the mortgage interest credit for the year and any carryover of the credit to next year. Web Form 8396 is for holders of Qualified Mortgage Credit Certificates MCC issued by state or local governmental units or agencies.

Ad Is your mortgage fully paid. Ad Aprio performs hundreds of RD Tax Credit studies each year. The certificate credit rate is shown on the.

Web Form 8396-Mortgage Interest Credit. Web The Mortgage Interest Credit is a nonrefundable credit intended to help lower-income individuals own a home. Web Up to 96 cash back Mortgage Interest Credit Form 8396.

Partner with Aprio to claim valuable RD tax credits with confidence. This webpage has the latest. Schedule K-1 Form 1065 Form 1120 And More.

A taxpayer may claim the mortgage interest credit if a. File Your Business Tax Forms With TurboTax. A mortgage credit certificate allows.

If you itemize your deductions on IRS Schedule A. Ad Aprio performs hundreds of RD Tax Credit studies each year. The IRS is not yet ready to accept returns filed with Form 8396 for the Mortgage Interest Credit in 2021.

My Turbotax CD version states. You have a qualified mortgage credit certificate. Our guided questionnaire will help you create your mortgage release contract in minutes.

I need to complete Form 8396 Mortgage Interest Credit in order to submit my return. Web To claim the credit complete IRS Form 8396 Mortgage Interest Credit and attach it to your income tax return. Partner with Aprio to claim valuable RD tax credits with confidence.

Web The mortgage tax credit is separate from the mortgage interest deduction which homeowners can also claim. Web More about the Federal Form 8396 Individual Income Tax Tax Credit TY 2022 We last updated the Mortgage Interest Credit in February 2023 so this is the latest version of. Ad Easily File Your Business Tax Forms With Full Service Business.

Create your mortgage release contract with our template. You can claim the mortgage interest credit if both of these are true.

Irs Form 8396 Mortgage Credit Certificate Mcc Program Federal Tax Credits Youtube

About Schedule 8812 Form 1040 Credits For Qualifying Children And Fill Out Sign Online Dochub

Jacksonville Record Observer 11 5 20 By Daily Record Observer Llc Issuu

The Irs 1098 Mortgage Interest Form Changes For 2016

Irs Forms Publications Lattaharris Llp

What Is A Mortgage Credit Certificate Mcc Is It Worth It Sofi

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

The Irs 1098 Mortgage Interest Changes For 2016

How To Fill Out Form 1098 Mortgage Interest Statement Pdfrun Youtube

:max_bytes(150000):strip_icc()/Tax_Advantages_Buying_Home_Sketch-ffc74833ef7744f2ba7377009ff52274.png)

What Is Form 8396 Mortgage Interest Credit How To Use

Digitalisierte Sammlungen Der Staatsbibliothek Zu Berlin Werkansicht Ahmedabad Ppn665260539 Phys 0377 Fulltext Endless

How To Prepare Irs Form 8396 Pocketsense

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Irs Form 8396 Download Fillable Pdf Or Fill Online Mortgage Interest Credit 2020 Templateroller

Form 8396 Mortgage Interest Credit

Home Mortgage Loan Interest Payments Points Deduction

19 Mortgage Forms Sample Free To Edit Download Print Cocodoc